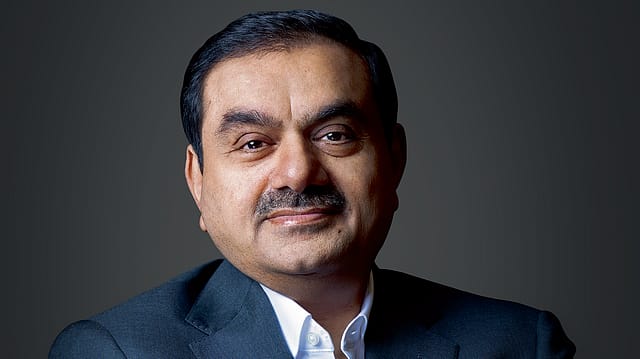

'Truth will prevail', says Gautam Adani on Supreme Court order

ADVERTISEMENT

Adani Group chairman Gautam Adani on Thursday said the conglomerate welcomes the top court's order as it will bring "finality" in a time bound manner.

"The Adani Group welcomes the order of the Hon'ble Supreme Court. It will bring finality in a time bound manner," Adani said, adding that "truth will prevail".

Shares of Adani Group's listed companies continued their gaining streak on Thursday. Shares of Adani Wilmar, Adani Power and Adani Green were locked in their 5% upper circuits. The stock Adani Enterprises, the group's flagship firm that called off its fully subscribed follow-on public offer (FPO) earlier this year, rose as much as 3% to ₹1,646 apiece on National Stock Exchange (NSE).

This comes as the Supreme Court directed market regulator SEBI (Securities and Exchange Board of India) to conclude its probe in the Adani-Hindenburg case within two months.

The apex court also constituted an expert committee headed by retired judge, Justice AM Sapre, to examine alleged violation of market laws by Adani Group and other listed companies. The panel comprises former SBI chairman OP Bhatt, Justice JP Devdatt, veteran banker KV Kamath, Infosys co-founder Nandan Nilekani and advocate Somasekhar Sundaresan.

The SC-appointed panel will provide an overall assessment of the situation including the relevant causal factors which have led to the volatility in the securities market in the recent past. The committee will investigate whether there has been a regulatory failure in dealing with the alleged violation of laws pertaining to the securities market. It will also suggest measures to strengthen investor awareness and the statutory and regulatory framework.

The committee has been asked to submit its report to the Supreme Court in a sealed cover within two months.

On January 24, U.S. short seller Hindenburg Research accused the Gautam Adani-led conglomerate of "pulling the largest con in corporate history".

The conglomerate, however, called the allegations as "malicious", "baseless" and a "calculated attack on India".

In February, SEBI said it has put in place "a set of well defined, publicly available surveillance measures" to address excessive volatility in specific stocks. "In all specific entity related matters, if any information comes to SEBI’s notice, then, as per extant policies, the same is examined and after due examination, appropriate action is taken," the capital markets regulator had said.

State-run insurer, Life Insurance Corporation of India (LIC) owns a 4.23% stake in Adani Enterprises. LIC also holds 9% in Adani Ports and Special Economic Zone (APSEZ), 3.7% in Adani Transmission, 1.3% in Adani Green Energy and 6% in Adani Total Gas.