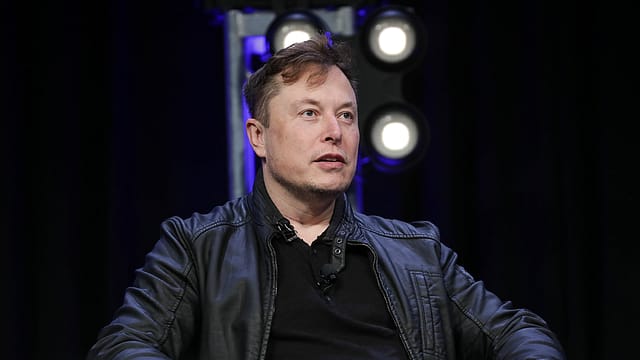

What lies ahead for Twitter after deal with Elon Musk?

ADVERTISEMENT

Elon Musk's bid to acquire social media platform Twitter has been successful but the real task to address the challenges that Tesla's CEO had flagged begins now. From ensuring free speech to diminishing spam bots, the world's richest man has promised the moon to people who believe in his vision. However, how he's going to bring in those changes and ensure they are not twisted when implemented in the real world, is unclear yet.

Musk’s plan starts with taking the company private. The deal has been sealed and once it’ll complete, Twitter will be a private company. “Twitter, Inc. has entered into a definitive agreement to be acquired by an entity wholly owned by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion. Upon completion of the transaction, Twitter will become a privately held company,” says a Twitter statement.

Being the biggest proponent of freedom of speech, Musk has some clear ideas in mind, which he’ll be able to implement once the company goes private. “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” says Musk.

He wants to make Twitter better than ever by enhancing the product with new features and making the algorithms open source to increase trust.

The process to take the company private, as per some estimates, could take around 6 months to complete. When a company goes private after being a public firm, shareholders typically sell their shares at a higher premium over the current market price. The company is delisted from the public stock exchanges and it's not answerable to public shareholders. In the past, many companies like Burger King, Dell Computers, H.J. Heinz have become private after being listed on stock exchanges.

Another immediate issue facing Musk would be organisational revamp. It'll be interesting to see if Musk thinks the current leadership, including CEO Parag Agrawal, is well suited to ensure the required changes or he wants someone else to take charge. For the record, Musk has repeatedly loathed the Twitter board and how the company runs. But who he’s going to trust is anybody’s guess right now. He has too much on his plate -- Tesla, SpaceX, Neuralink, and The Boring Company -- but some say he would certainly need to divert some focus onto Twitter to bring structural changes.

On the funding part, there’s one mystery yet to be solved – how he's going to fund the $21 billion equity guarantee. He assured that has secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21 billion equity commitment. It’s not clear how he’ll ensure the $21 billion equity commitment. Though it’s not difficult for the world’s richest man with a net worth of $257 billion – he could rope in other investors or pledge some of his shares in Tesla – all that comes at a price.

Meanwhile, it’s raining money for Twitter shareholders now as the deal is signed. Under the terms of the agreement, Twitter shareholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing the proposed transaction. The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Musk disclosed his 9.1% stake in Twitter.