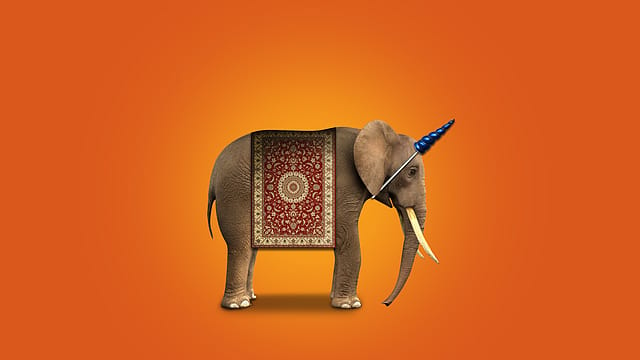

The year of the unicorns

ADVERTISEMENT

Last year, the Covid-19 pandemic dealt a major financial blow to many businesses across sectors. But the pandemic has had a silver lining: In 2020, India saw the rise of 11 new unicorns—which are basically privately-held companies that have reached a valuation of $1 billion, or more. This is the highest ever in a single year. In the last four months of this year alone, however, India witnessed about 10 new companies achieving unicorn status. The list includes PharmEasy, Meesho, Gupshup, Groww, Cred, Innovaccer, Sharechat, Digit Insurance, Five Star Business Finance, and Infra.Market.

Here is a list of those 11 unicorns of 2020.

UNACADEMY

Co-founders: Gaurav Munjal, Roman Saini, Hemesh Singh

Education technology (edtech) companies were among the most funded players last year, including Unacademy which raised $150 million in a funding round led by Japan’s SoftBank in September. The investment valued Unacademy at $1.45 billion, making it the second edtech company after Byju’s to be part of India’s unicorn club. Unacademy started first as a YouTube channel for educational videos and now provides live interactive classes.

GLANCE

Co-founders: Naveen Tewari, Abhay Singhal, Mohit Saxena, Piyush Shah

Lock screen platform Glance, which is a subsidiary of InMobi, in December raised $145 million from Internet giant Google and existing investor Mithril Capital, catapulting the company to unicorn status. The Glance app uses artificial intelligence to create personalised content of news, sports, entertainment, and video games in multiple languages such as English, Hindi, Tamil, Telugu, and Bahasa on the lock screen of Android smartphones.

NYKAA

Founder, Falguni Nayar

Last year, the eight-yearold Nykaa raised ₹166 crore as primary investment from Steadview Capital at a valuation of $1.2 billion, making its entry into the unicorn club. Having started in 2012, the beauty and fashion retailer was a late entrant into the e-commerce market, but being a specialised retailer helped it stay strongly in the game. Nykaa retails over 2,500 brands across beauty and fashion through its online and offline stores

PINE LABS

Founder, Lokvir Kapoor

Last December, when fintech company Pine Labs raised about $100 million in funding—which was led by American hedge fund Lone Pine Capital—it was valued at over $2 billion. Pine Labs, which provides point-of-sale terminals in stores, has over 150,000 merchants in its network, across India, South-East Asia, and the Middle East. It aims to onboard a mil - lion new merchants this year.

FIRSTCRY

Co-founders, Supam Maheshwari, Amitava Saha

FirstCry, the online-offline retailer of baby care products, raised around $300 million early last year from SoftBank Group’s Vision Fund. It catapulted the company’s valuation to over $1 billion. The investment at the time was the first tranche of the total $400 million funding commit - ted by the Japanese tech conglomerate. FirstCry currently has over 400 offline stores across the country.

ZENOTI

Co-founders, Sudheer Koneru, Dheeraj Koneru

Zenoti, a provider of cloud-based enterprise management software for the beauty and wellness industry, raised $160 million in a Series D funding round, at an over $1 billion valuation, in December. The company provides software support to more than 12,000 businesses including spas and fitness centres in over 50 countries. Till date, Zenoti has raised a total of over $250 million.

POSTMAN

Co-founders, Abhinav Asthana, Ankit Sobti, Abhijit Kane

During Covid-19, Post - man raised $150 million in a Series C funding round led by New Yorkbased venture capital fund Insight Partners, at a valuation close to $2 billion. Postman is an application programming interface (API) development platform that is used by developers to manage their API—a set of code that enables interaction between different software.

ZERODHA

Co-founders, Nithin Kamath, Nikhil Kamath

Zerodha, one of India’s largest brokerage houses, claimed unicorn status in June when it announced an employee stock ownership plan (ESOP). The stock-trading platform claimed it will spend about ₹65 crore to buy back employee stock options at a self-assessed valuation of about $1 billion. Nithin Kamath founded the company in 2010 to overcome the hurdles traders face in the broking industry.

DAILYHUNT

Founder, Virendra Gupta, co-founder, Umang Bedi

The local language news and content aggregator, Dailyhunt raised more than $100 million in December—from Google, Microsoft, and AlphaWave, a unit of Falcon Edge Capital—that valued the company at over $1 billion. Dailyhunt claims to have over 300 million users consuming local content on its platform, while its short video app, Josh, is said to have crossed over 50 million downloads.

RAZORPAY

Co-founders, Harshil Mathur, Shashank Kumar

As more businesses opted for digital services during the Covid-19 pandemic, payment services company Razorpay witnessed a surge in demand for its financial products and services. In October, the fintech firm raised $100 million in a series D funding round which was co-led by Singapore’s sovereign wealth fund GIC and Sequoia India, that valued the six-year-old startup at over $1 billion.

CARS24

Co-founders, Vikram Chopra, Mehul Agrawal, Ruchit Agarwal, Gajendra Jangid

In November, CARS24— an online transaction platform for used cars— raised $200 million in a Series E funding round led by Russian billionaire Yuri Milner’s fund DST Global at a valuation of over $1 billion. The company will utilise the capital to ramp up its technology and scale up new business verticals such as customer financing and two-wheelers.

(This story originally appeared in Fortune India's April 2021 issue).